Our theme this month is diversification. Diversifying investments can mitigate risk by balancing the ups and downs of individual shares, and individual countries to reduce their impact on your entire portfolio. A diversified portfolio is more resilient because it’s designed to capture growth while providing relative security during market downturns.

Similar Posts

Newsletter – May 2022

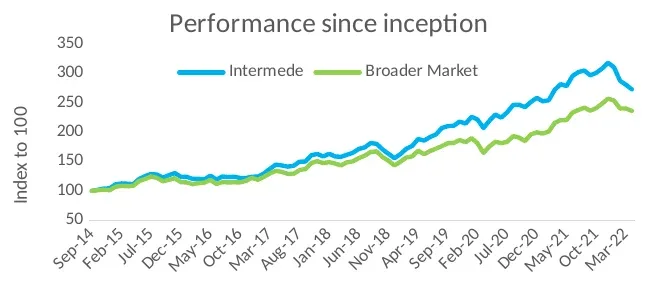

Introducing our new Active Global manager, Intermede, and a taste of some of their investments.

Newsletter – November 2023

This issue covers our human nature of feeling twice as much pain from an investment loss as we do pleasure from a gain, and while it can be tempting to view our investments daily, the key to long-term investment success is being invested over the longer term.

Newsletter – September 2024

Our theme this month is Trump vs Harris – what the different parties are offering and how the US Presidential election may affect the markets.

Newsletter – June 2023

This issue covers broadening Booster’s direct investments in attractive, unlisted NZ assets – FleetPartners.

Newsletter – March 2024

This month we unpack diversification. Diversification is a strategy to lower investment risk by spreading money across and within different asset classes, such as shares, bonds and cash. It’s one of the best ways to weather market ups and downs and maintain the potential for growth.

Newsletter – August 2022

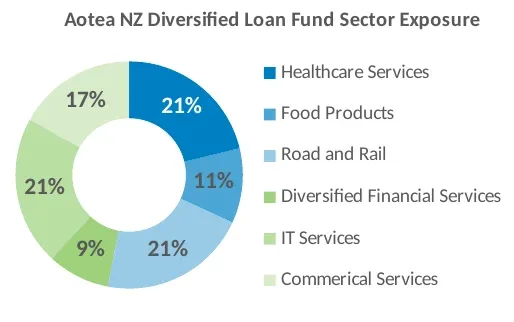

Broadening Booster’s direct investments in attractive, unlisted NZ assets – Aotea Asset Management.