This month we lift the lid on shareholder voting. Our aim is to ensure that the companies that you are invested in are well-governed, responsible corporate citizens, and acting in your best interests.

Similar Posts

Newsletter – June 2024

This month’s theme is the benefits of active management. Active management allows us to manage specific risks, adjust to market conditions, and uncover hidden investment opportunities. Dutch company ASML has been an exciting recent success story.

Newsletter – April 2022

Widening Booster’s direct investments in attractive, unlisted NZ assets – helping local Iwi fund the purchase of 40 Wellington school properties.

Newsletter – June 2023

This issue covers broadening Booster’s direct investments in attractive, unlisted NZ assets – FleetPartners.

Newsletter – April 2025

This month our theme is making sense of the “Liberation Day” tariffs, how these events unfolded and what this means for your investments.

Newsletter – January 2025

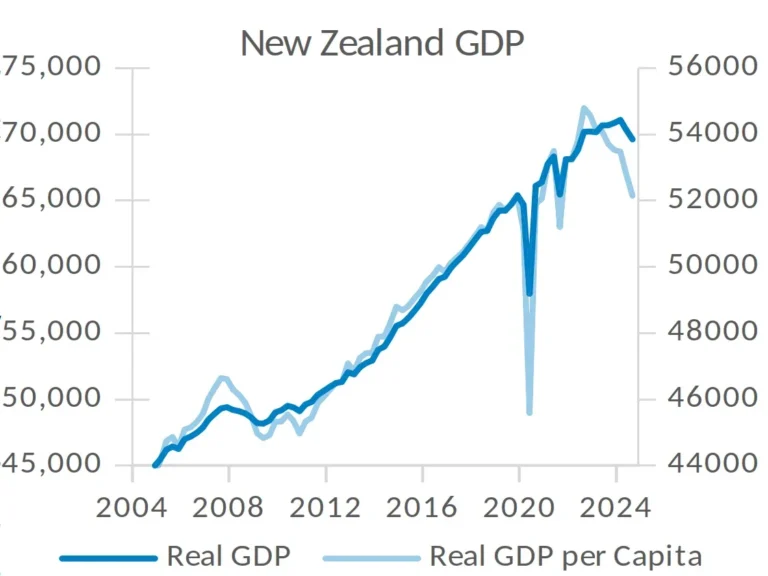

This month we check in on the NZ Economy and the role of GDP as an indicator of growth.

Newsletter – May 2022

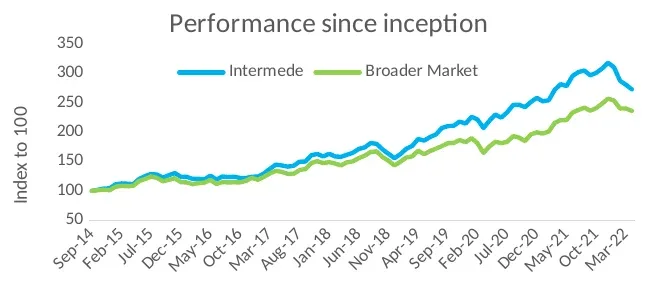

Introducing our new Active Global manager, Intermede, and a taste of some of their investments.