This issue shows the methods used to support returns during periods of market volatility. Using the New Zealand dollar as a ‘shock absorber’.

Similar Posts

Newsletter – May 2022

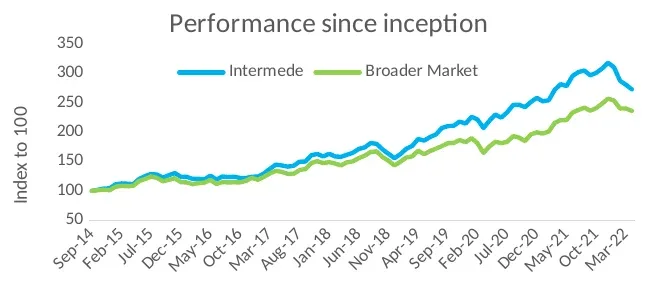

Introducing our new Active Global manager, Intermede, and a taste of some of their investments.

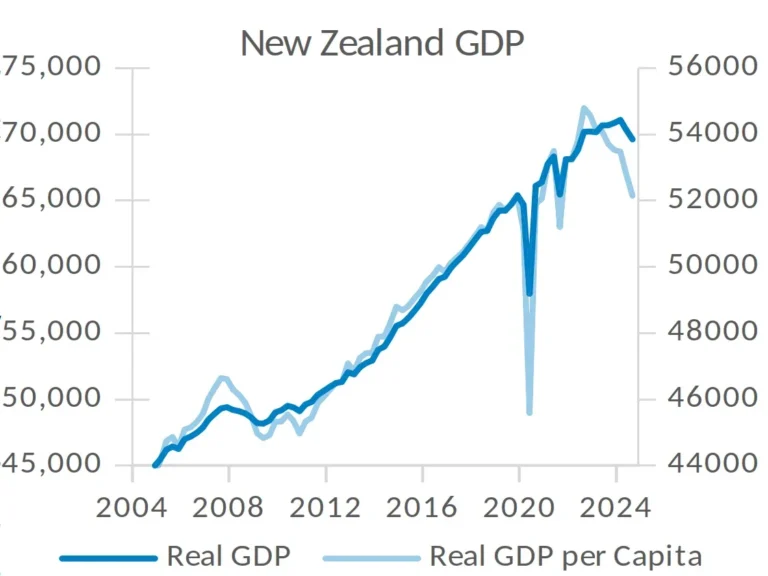

Newsletter – January 2025

This month we check in on the NZ Economy and the role of GDP as an indicator of growth.

Newsletter – June 2023

This issue covers broadening Booster’s direct investments in attractive, unlisted NZ assets – FleetPartners.

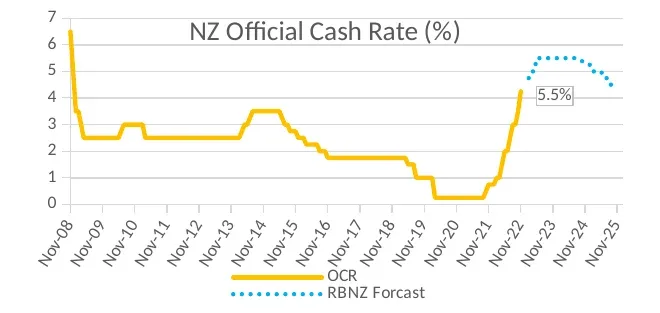

Newsletter – November 2022

The Reserve Bank of New Zealand is getting tough on inflation. The relationship between interest rates and inflation and what this means for your investments.

Newsletter – January 2024

Our theme this month is Albert Einstein’s Eighth Wonder of the World – The Power of Compounding.

Newsletter – May 2025

This month our theme this month is time in the market vs timing the market. Avoiding the perils of emotionally driven investment decisions, which can often lead to missed opportunities and lower overall returns.