This month our theme this month is time in the market vs timing the market. Avoiding the perils of emotionally driven investment decisions, which can often lead to missed opportunities and lower overall returns.

Similar Posts

Newsletter – June 2022

This issue covers built-in ‘shock absorbers’ within your portfolio to cushion the effect of market volatility.

Newsletter – October 2025

This month we explore how US businesses have coped following President Trump’s ‘Liberation Day’ tariffs in April, and outline the state of the general US economy.

Newsletter – May 2023

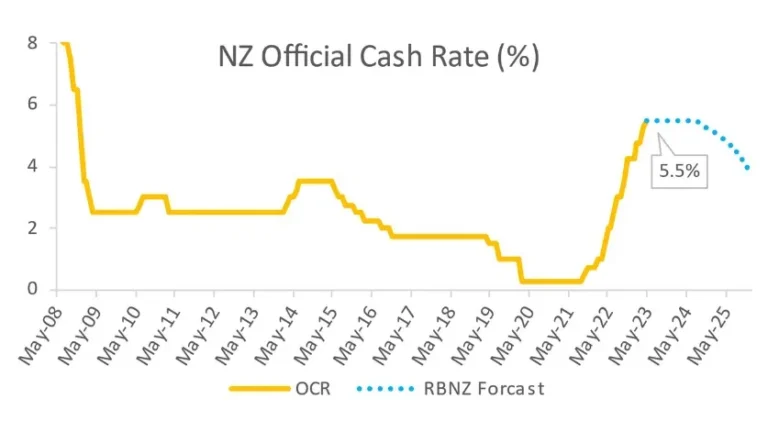

Our theme this month is the inflation taming efforts of the Reserve Bank of New Zealand and the link between inflation and interest rates.

Newsletter – August 2025

Our theme this month is private income investments – an asset class that is quietly becoming one of the fastest-growing parts of the investment world.

Newsletter – April 2022

Widening Booster’s direct investments in attractive, unlisted NZ assets – helping local Iwi fund the purchase of 40 Wellington school properties.

Newsletter – July 2022

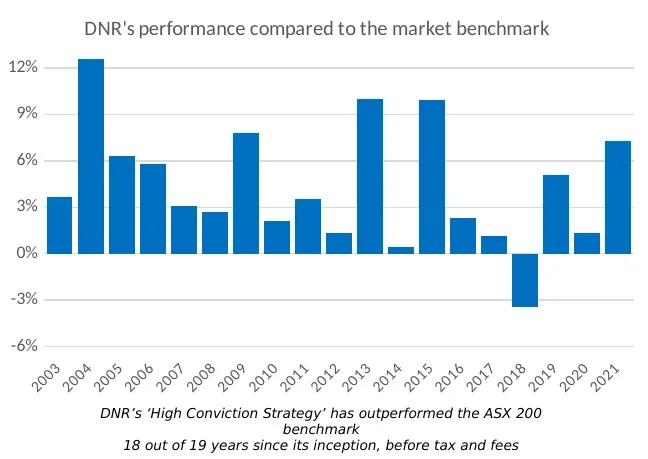

Introducing our new Australian Active manager, DNR Capital, and a taste of their investment philosophy.